Business Analysts

-

Futurum Acquires Technology Analyst Firm Evaluator Group

AUSTIN, Texas–(Business WIRE)–The Futurum Group, a keeping enterprise comprised of a loved ones of industry research corporations targeted on analyzing emerging and industry-disrupting systems, determining and validating developments, and providing info and insights that empower clients to come across their aggressive edge in the electronic financial state, has announced the acquisition of Evaluator Team. “Evaluator Group’s deep intelligence and pragmatic expertise with IT functions provides benefit to The Futurum Group’s suite of offerings and capabilities, furthering our industry technique and abundant companies and offering a much greater amount of industry insights for our collective shoppers,” mentioned Daniel Newman, CEO and principal analyst at Futurum Research. “The addition of Evaluator Group…

-

There’s Been No Shortage Of Growth Recently For Boustead Plantations Berhad’s (KLSE:BPLANT) Returns On Capital

What traits need to we seem for it we want to discover stocks that can multiply in worth more than the long expression? Typically, we will want to recognize a development of growing return on money utilized (ROCE) and alongside that, an growing foundation of funds utilized. If you see this, it generally usually means it’s a enterprise with a wonderful small business product and a lot of profitable reinvestment opportunities. So when we seemed at Boustead Plantations Berhad (KLSE:BPLANT) and its craze of ROCE, we genuinely preferred what we observed. What Is Return On Funds Used (ROCE)? If you have not worked with ROCE ahead of, it steps the…

-

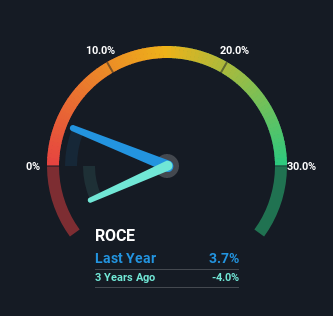

Supermax Corporation Berhad (KLSE:SUPERMX) Is Reinvesting At Lower Rates Of Return

If you might be not positive exactly where to begin when seeking for the next multi-bagger, there are a handful of critical traits you ought to continue to keep an eye out for. Ideally, a small business will present two tendencies to begin with a expanding return on funds used (ROCE) and next, an rising total of funds employed. This reveals us that it truly is a compounding equipment, in a position to continually reinvest its earnings back again into the business enterprise and deliver bigger returns. Whilst, when we seemed at Supermax Company Berhad (KLSE:SUPERMX), it did not seem to tick all of these boxes. Return On Money Employed…

-

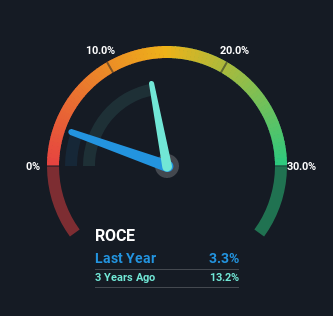

Synopsys (NASDAQ:SNPS) Is Looking To Continue Growing Its Returns On Capital

What developments should really we glance for it we want to detect shares that can multiply in price above the very long term? A person widespread method is to check out and uncover a business with returns on money used (ROCE) that are raising, in conjunction with a expanding total of money utilized. Ultimately, this demonstrates that it’s a company that is reinvesting profits at raising charges of return. With that in brain, we have found some promising developments at Synopsys (NASDAQ:SNPS) so let’s seem a bit deeper. Comprehending Return On Cash Utilized (ROCE) For these that aren’t confident what ROCE is, it actions the amount of money of pre-tax…

-

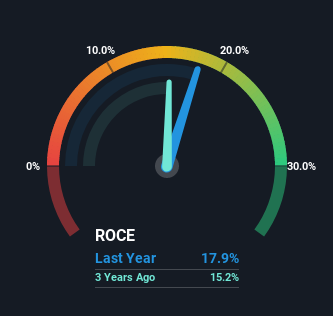

Techtronic Industries (HKG:669) Might Have The Makings Of A Multi-Bagger

If we want to uncover a inventory that could multiply in excess of the extended time period, what are the fundamental developments we need to glance for? Preferably, a business enterprise will demonstrate two developments to begin with a rising return on capital employed (ROCE) and next, an rising total of funds utilized. Finally, this demonstrates that it is a enterprise that is reinvesting earnings at raising costs of return. Speaking of which, we discovered some great modifications in Techtronic Industries’ (HKG:669) returns on capital, so let us have a search. What Is Return On Funds Employed (ROCE)? For those people who you should not know, ROCE is a measure…

-

Tan Chong Motor Holdings Berhad’s (KLSE:TCHONG) Returns On Capital Are Heading Higher

Did you know there are some fiscal metrics that can offer clues of a prospective multi-bagger? Amongst other factors, we’ll want to see two issues for starters, a rising return on cash employed (ROCE) and secondly, an expansion in the company’s amount of money of capital employed. Put basically, these kinds of enterprises are compounding devices, meaning they are frequently reinvesting their earnings at at any time-bigger fees of return. Speaking of which, we observed some wonderful adjustments in Tan Chong Motor Holdings Berhad’s (KLSE:TCHONG) returns on money, so let’s have a glimpse. Return On Funds Used (ROCE): What Is It? If you have not labored with ROCE in advance…