Business Analysts

-

Technical Analysis for Equity CFD Traders: Essential Tools and Techniques

In the realm of equity Contracts for Difference (CFD) trading, mastering technical analysis is a cornerstone for making informed decisions and achieving consistent profitability. This article delves into the fundamental principles, indispensable tools, key techniques, and practical applications of technical analysis specifically tailored for equity CFD traders. Understanding Technical Analysis Technical analysis is the art and science of analysing historical price and volume data to forecast future price movements. Unlike fundamental analysis, which focuses on a company’s financial health and qualitative factors, technical analysis relies purely on market data. For equity CFD traders, understanding technical analysis provides crucial insights into market trends, momentum shifts, and potential entry and exit points.…

-

Stephens analysts expect J.B. Hunt 4Q earnings, revenue to rise

Analysts explained that Lowell-centered provider J.B. Hunt Transport Services Inc. is expected to submit an raise in fourth-quarter earnings amid a soft freight marketplace. In the meantime, J.B. Hunt has arrived at a extensive-expression offer to increase far more than 15,000 trailers in the coming many years. Prior to the marketplaces open Wednesday (Jan. 18), J.B. Hunt is projected to report fourth-quarter earnings per share rose to $2.47, from $2.28 in the exact same time period in 2021, primarily based on a consensus of 22 analysts. For 2022, earnings for every share are envisioned to increase to $9.76 from $7.14 in 2021. Fourth-quarter profits is anticipated to rise by 9.9{8ba6a1175a1c659bbdaa9a04b06717769bcea92c0fdf198d429188ebbca09471}…

-

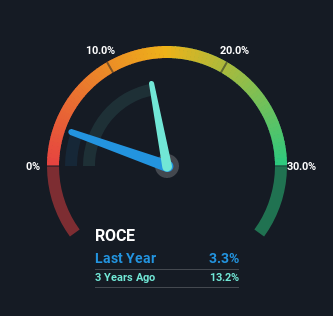

Under The Bonnet, Harte Hanks’ (NASDAQ:HHS) Returns Look Impressive

There are a handful of essential developments to glimpse for if we want to recognize the up coming multi-bagger. Preferably, a business enterprise will display two trends to begin with a escalating return on capital employed (ROCE) and next, an escalating sum of money utilized. This reveals us that it is a compounding equipment, capable to continually reinvest its earnings again into the enterprise and generate better returns. And in light-weight of that, the traits we’re viewing at Harte Hanks’ (NASDAQ:HHS) look quite promising so lets just take a glimpse. What Is Return On Funds Used (ROCE)? Just to make clear if you might be not sure, ROCE is a…

-

5 business technology predictions for 2023

In the land of company IT, the main shifts that challenge leaders start off to exhibit up step by step — then all at after. Analysts and market watchers generally flag bleeding edge technological know-how providers or mounting industry tendencies forward of their comprehensive-fledged advancement, giving know-how leaders a probability to prepare for what’s coming. Timely adoption of these technologies can be elusive. CIOs’ decisions could make or split companies in a year that forecasters be expecting will bring financial problems. From picking out new technologies to attracting plenty of tech employees or executing broader transformation, engineering leaders need to attempt to assess the top IT tendencies and act on…

-

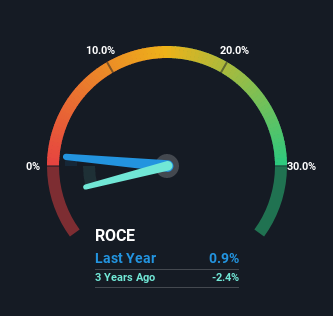

Why We Like The Returns At Gas Malaysia Berhad (KLSE:GASMSIA)

If you’re not confident the place to get started when wanting for the following multi-bagger, there are a couple of essential tendencies you need to continue to keep an eye out for. Generally, we’ll want to discover a pattern of escalating return on funds employed (ROCE) and alongside that, an growing base of funds used. This displays us that it is really a compounding equipment, capable to constantly reinvest its earnings back again into the business enterprise and create increased returns. With that in mind, the ROCE of Gasoline Malaysia Berhad (KLSE:GASMSIA) appears to be fantastic, so allows see what the trend can tell us. Understanding Return On Capital Used…

-

Envictus International Holdings (SGX:BQD) Might Have The Makings Of A Multi-Bagger

If we want to come across a prospective multi-bagger, often there are underlying traits that can give clues. In a ideal planet, we might like to see a company investing a lot more cash into its enterprise and ideally the returns acquired from that capital are also increasing. Place just, these styles of enterprises are compounding devices, which means they are regularly reinvesting their earnings at at any time-better premiums of return. So on that note, Envictus Worldwide Holdings (SGX:BQD) appears to be really promising in regards to its developments of return on capital. Return On Cash Utilized (ROCE): What Is It? For all those who will not know, ROCE…