Business Analysts

-

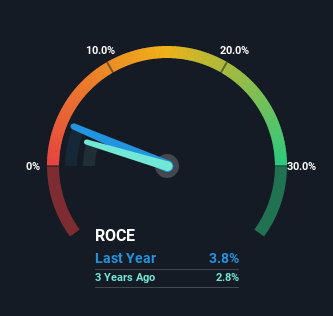

We Like These Underlying Return On Capital Trends At Kumpulan Perangsang Selangor Berhad (KLSE:KPS)

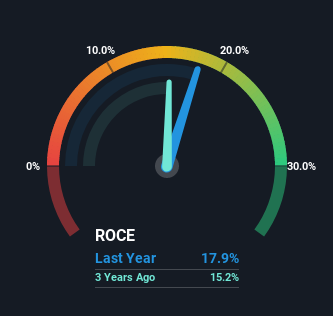

Acquiring a enterprise that has the likely to mature substantially is not simple, but it is probable if we seem at a number of key economical metrics. In a best planet, we’d like to see a firm investing a lot more cash into its business enterprise and ideally the returns gained from that money are also increasing. This shows us that it is really a compounding device, ready to continuously reinvest its earnings back again into the company and create better returns. Talking of which, we discovered some terrific modifications in Kumpulan Perangsang Selangor Berhad’s (KLSE:KPS) returns on cash, so let us have a appear. What Is Return On Capital…

-

13 Industry Experts Predict Rising Business Tech Trends Of 2023

getty Due to the fact the onset of the Covid-19 pandemic, it has seemed that company technologies has evolved and expanded at an astounding charge. Although the immediate impacts of the pandemic are commencing to fade, business enterprise tech is poised to proceed to evolve, with both of those new resources and focuses that will adjust the means organizations make selections, interact with clients, manage details and extra. Figuring out what’s to come can aid company leaders pinpoint the tendencies that could affect their industries and, most likely, increase their bottom strains. Down below, 13 marketplace authorities from Forbes Technology Council share their predictions for the business enterprise tech trends…

-

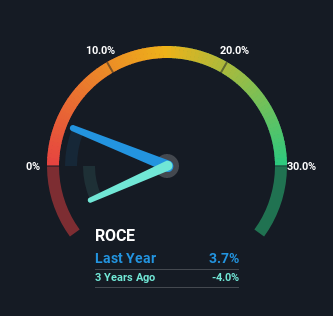

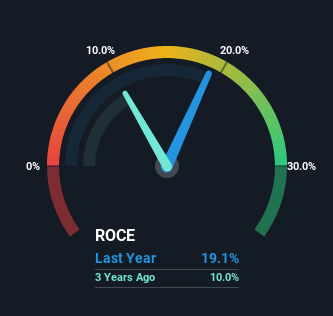

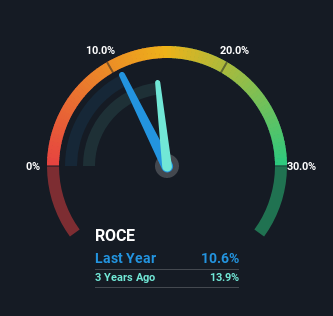

Kim Heng (Catalist:5G2) Is Doing The Right Things To Multiply Its Share Price

Did you know there are some money metrics that can supply clues of a opportunity multi-bagger? Among other factors, we will want to see two issues firstly, a rising return on money employed (ROCE) and next, an expansion in the company’s total of funds employed. If you see this, it ordinarily indicates it can be a organization with a excellent business enterprise model and loads of lucrative reinvestment chances. Talking of which, we noticed some excellent adjustments in Kim Heng’s (Catalist:5G2) returns on cash, so let’s have a glance. What Is Return On Funds Used (ROCE)? For those people that are not absolutely sure what ROCE is, it measures the…

-

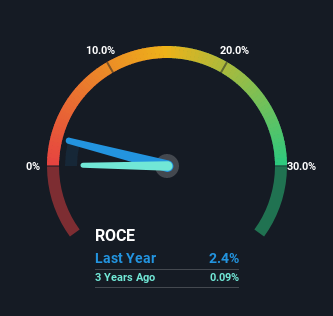

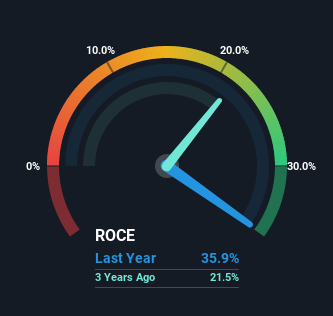

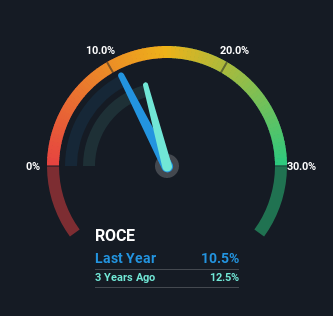

Shareholders Would Enjoy A Repeat Of PBT Group’s (JSE:PBG) Recent Growth In Returns

Did you know there are some financial metrics that can supply clues of a potential multi-bagger? Firstly, we are going to want to see a established return on capital used (ROCE) that is escalating, and secondly, an growing base of cash used. Generally this means that a company has profitable initiatives that it can carry on to reinvest in, which is a trait of a compounding device. With that in brain, the ROCE of PBT Group (JSE:PBG) appears to be like wonderful, so lets see what the craze can convey to us. What Is Return On Capital Employed (ROCE)? If you haven’t labored with ROCE right before, it steps the…

-

‘Bank to the stars’ earns $3.5 million grant to add 250 jobs in Delaware

Editor’s note: A preceding edition of this story misstated the salary threshold for new City Countrywide Financial institution staff members. The new positions will have an typical commencing salary of $80,000. Metropolis Nationwide Lender is organizing to use about 250 workforce above the next several decades as aspect of an enlargement in Delaware for administrative and back again-close get the job done. The Los Angeles-based business designs to open up an business office in Ogletown’s Iron Hill Company Center and commence hiring functions administrators, project supervisors, small business analysts, operations specialists and other positions early upcoming 12 months. A agent from Metropolis Nationwide reported the ordinary starting off salary will…

-

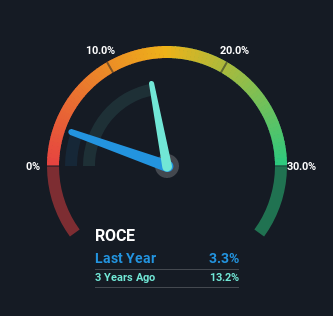

Be Wary Of Wabash National (NYSE:WNC) And Its Returns On Capital

To avoid investing in a business that’s in decline, there’s a few financial metrics that can provide early indications of aging. When we see a declining return on capital employed (ROCE) in conjunction with a declining base of capital employed, that’s often how a mature business shows signs of aging. This combination can tell you that not only is the company investing less, it’s earning less on what it does invest. And from a first read, things don’t look too good at Wabash National (NYSE:WNC), so let’s see why. What Is Return On Capital Employed (ROCE)? Just to clarify if you’re unsure, ROCE is a metric for evaluating how much…