Debt Loan

-

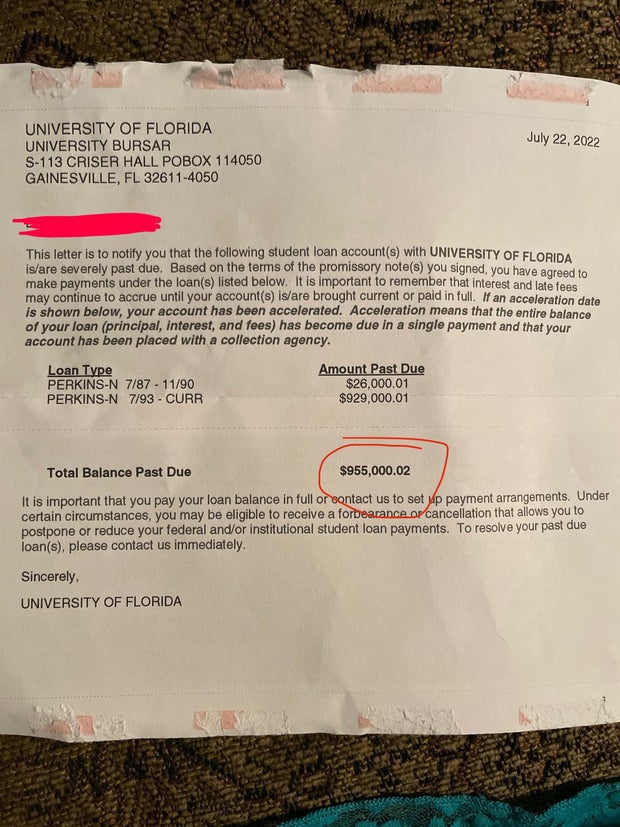

A Florida teacher thought she’d settled her student loan debt 20 years ago. Then she got a bill for $1 million.

For pretty much a ten years, the authorities took hundreds of bucks every thirty day period out of the paychecks of a Florida woman named Michelle to recoup previous student loans that were being unpaid and overdue. The method, known as garnishment, is legal, and the U.S. Section of Training can purchase it for someone’s wages, tax returns and Social Protection to power repayment on defaulted loans. Michelle’s garnishment began in 2008. As a general public university teacher in Orlando, who questioned to be discovered by her initially name only simply because this tale consists of her own finances, she struggled for the upcoming eight or nine many years to…

-

How the Supreme Court Could Rule on Student Loan Forgiveness

The U.S. Supreme Court docket is making ready to weigh in on the authorized struggle around President Biden’s university student financial loan forgiveness plan, which is now blocked by two various rulings. But, legal industry experts say that even if the court sides with the Biden Administration, there are continue to legal hurdles that will hold off relief for debtors. In a submitting on Friday, Solicitor Common Elizabeth Prelogar requested the Supreme Court docket to vacate a nationwide injunction on the personal debt-forgiveness plan or “set the circumstance for expedited briefing and argument this Time period to avoid prolonging this uncertainty for the millions of impacted debtors.” In the meantime,…

-

Student loan forgiveness approval letters are going out. Here’s what that means.

About 16 million debtors who had utilized for the Biden administration’s pupil mortgage forgiveness program been given letters above the weekend letting them know that they have been approved for credit card debt reduction. Nevertheless, the letter states that a range of lawsuits “have blocked our capacity to discharge your credit card debt at existing.” The approvals come following two courts blocked the strategy, putting legal boundaries right before a federal program that had promised to forgive up to $20,000 in university student credit card debt for about 40 million suitable Us citizens. “Your software is total and accredited, and we will discharge your accepted financial debt if and when we prevail…

-

What is ‘Zombie Debt?’ Homeowners face foreclosure on old mortgages.

Rose Prophete believed the 2nd mortgage bank loan on her Brooklyn home was settled about a 10 years back — right up until she acquired paperwork saying she owed more than $130,000. “I was shocked,” mentioned Prophete, who refinanced her two-household dwelling in 2006, six a long time following arriving from Haiti. “I don’t even know these persons due to the fact they hardly ever contacted me. They hardly ever called me.” Prophete is section of a wave of house owners who say they have been blindsided by the start of foreclosures steps on their homes over next loans that had been taken out far more than a decade in…

-

Student loan relief: Biden administration notifies approved applicants as program remains tied up in courts

CNN — The Biden administration started off notifying individuals who are approved for federal university student personal loan reduction on Saturday even as the upcoming of that reduction continues to be in limbo just after lower courts blocked the application nationwide. The Department of Education and learning began sending email messages to debtors who have been accepted to have their federal pupil financial loans relieved, outlining that latest legal difficulties have saved the administration from discharging the debt. “We reviewed your application and established that you are qualified for loan aid underneath the Approach,” Training Secretary Miguel Cardona wrote in the e-mail, which was furnished to CNN. “We have sent…

-

Biden Administration asks Supreme Court to lift student loan forgiveness block

U.S. President Joe Biden speaks about pupil loan personal debt at the White Household on Aug. 24, 2022 in Washington, DC. Alex Wong | Getty The Biden administration on Friday requested the Supreme Court to reinstate its federal college student mortgage program immediately after a federal appeals court docket issued a nationwide injunction against the program. The administration’s ask for, which was previewed in an additional court submitting Thursday, blasted the U.S. Courtroom of Appeals for the 8th Circuit for blocking the credit card debt relief prepare. That injunction was issued previously in reaction to a lawsuit by a team of Republican-managed states. “The Eighth Circuit’s faulty injunction leaves thousands…