-

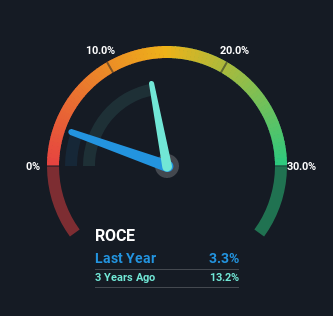

Why We Like The Returns At Gas Malaysia Berhad (KLSE:GASMSIA)

If you’re not confident the place to get started when wanting for the following multi-bagger, there are a couple of essential tendencies you need to continue to keep an eye out for. Generally, we’ll want to discover a pattern of escalating return on funds employed (ROCE) and alongside that, an growing base of funds used. This displays us that it is really a compounding equipment, capable to constantly reinvest its earnings back again into the business enterprise and create increased returns. With that in mind, the ROCE of Gasoline Malaysia Berhad (KLSE:GASMSIA) appears to be fantastic, so allows see what the trend can tell us. Understanding Return On Capital Used…

-

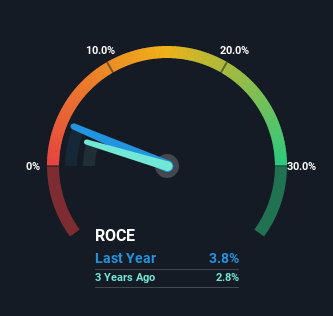

Supermax Corporation Berhad (KLSE:SUPERMX) Is Reinvesting At Lower Rates Of Return

If you might be not positive exactly where to begin when seeking for the next multi-bagger, there are a handful of critical traits you ought to continue to keep an eye out for. Ideally, a small business will present two tendencies to begin with a expanding return on funds used (ROCE) and next, an rising total of funds employed. This reveals us that it truly is a compounding equipment, in a position to continually reinvest its earnings back again into the business enterprise and deliver bigger returns. Whilst, when we seemed at Supermax Company Berhad (KLSE:SUPERMX), it did not seem to tick all of these boxes. Return On Money Employed…

-

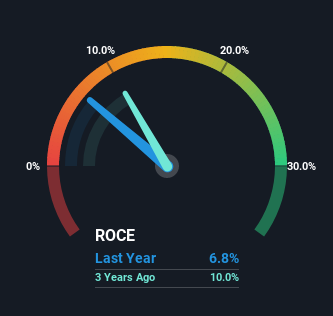

Bahvest Resources Berhad (KLSE:BAHVEST) Is Experiencing Growth In Returns On Capital

What trends should really we glimpse for it we want to discover stocks that can multiply in benefit more than the very long time period? In a fantastic environment, we’d like to see a company investing extra funds into its organization and ideally the returns earned from that cash are also escalating. Finally, this demonstrates that it really is a enterprise that is reinvesting gains at increasing costs of return. So on that observe, Bahvest Assets Berhad (KLSE:BAHVEST) looks fairly promising in regards to its tendencies of return on funds. Return On Money Used (ROCE): What Is It? Just to make clear if you’re uncertain, ROCE is a metric for…

-

We Like These Underlying Return On Capital Trends At Kumpulan Perangsang Selangor Berhad (KLSE:KPS)

Acquiring a enterprise that has the likely to mature substantially is not simple, but it is probable if we seem at a number of key economical metrics. In a best planet, we’d like to see a firm investing a lot more cash into its business enterprise and ideally the returns gained from that money are also increasing. This shows us that it is really a compounding device, ready to continuously reinvest its earnings back again into the company and create better returns. Talking of which, we discovered some terrific modifications in Kumpulan Perangsang Selangor Berhad’s (KLSE:KPS) returns on cash, so let us have a appear. What Is Return On Capital…

-

Returns At Federal International Holdings Berhad (KLSE:FIHB) Appear To Be Weighed Down

If you are not positive where to start off when seeking for the subsequent multi-bagger, there are a handful of crucial tendencies you ought to retain an eye out for. In a best globe, we might like to see a corporation investing additional funds into its business and ideally the returns earned from that cash are also expanding. Put basically, these types of companies are compounding equipment, meaning they are continuously reinvesting their earnings at ever-greater prices of return. Whilst, when we appeared at Federal Intercontinental Holdings Berhad (KLSE:FIHB), it didn’t look to tick all of these boxes. Return On Capital Used (ROCE): What Is It? For individuals who will…

-

Hume Cement Industries Berhad (KLSE:HUMEIND) Has More To Do To Multiply In Value Going Forward

If you happen to be not certain the place to get started when on the lookout for the subsequent multi-bagger, there are a couple crucial developments you should maintain an eye out for. Amongst other points, we will want to see two issues firstly, a escalating return on capital used (ROCE) and next, an expansion in the company’s volume of money used. In the end, this demonstrates that it can be a company that is reinvesting revenue at rising charges of return. Even so, immediately after briefly on the lookout above the quantities, we don’t assume Hume Cement Industries Berhad (KLSE:HUMEIND) has the makings of a multi-bagger heading ahead, but…