-

Bill Schubart: Keep private investors away from nonprofits in health care, journalism, corrections

An outdated stone wall in the Marshfield city forest. File photograph by Cate Chant/VTDigger The incursion of non-public-fairness traders into nonprofit well being treatment, journalism and corrections is doing untold societal and economic damage in the assistance of high-pace profiteering. Non-public fairness buyers, normally minimal partnerships, find the right combine of fairness and financial debt and usually buy and restructure businesses that are not publicly traded. With number of regulatory barriers or constraints, they are significantly trying to find prospect in the nonprofit sector, giving them the prospect to harvest monetary price from taxpayer-funded govt resources this kind of as Medicare, Medicaid and Social Safety. Vermont (and the nation) have…

-

Wildcats take care of business at home against Saint Martin’s

Up coming Match: Lincoln (Calif.) 12/9/2022 | 5:00 PM

Dec. 09 (Fri) / 5:00 PM

Lincoln (Calif.)

Heritage

ELLENSBURG, Wash. – The Central Washington women’s basketball team (7-1, 2- GNAC) stayed undefeated in meeting motion Saturday night time with a convincing 74-54 victory over the traveling to Saint Martin’s Saints (3-6, -2 GNAC) at Ellensburg Substantial College. Quote FROM HEAD Coach RANDI RICHARDSON-THORNLEY “I’m pleased with how we competed in the first half. We showed depth and regularity defensively and were being able to rebound perfectly out of it. Offensively I appreciated the pace we performed with in the 1st half and how…

-

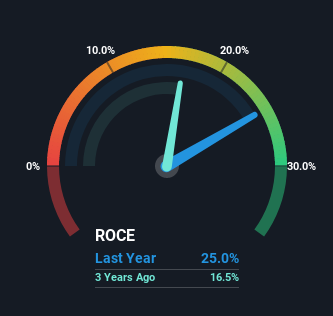

Why You Should Care About LCI Industries’ (NYSE:LCII) Strong Returns On Capital

Discovering a small business that has the likely to improve significantly is not effortless, but it is possible if we glimpse at a couple vital financial metrics. To begin with, we’d want to establish a expanding return on funds used (ROCE) and then alongside that, an ever-escalating base of capital used. In the end, this demonstrates that it’s a enterprise that is reinvesting revenue at increasing charges of return. Which is why when we briefly seemed at LCI Industries’ (NYSE:LCII) ROCE trend, we were quite happy with what we observed. Return On Capital Utilized (ROCE): What Is It? For people who will not know, ROCE is a measure of a…

-

How Oath Care, FOLX are inflation proofing their growth

Although broader financial difficulties and increased advertising and marketing expenditures are most likely to persist, some digital health and fitness organizations are building platforms that could be resilient. A developing range of buyer-dealing with businesses are developing grassroots communities as an alternative of obtaining buyers with traditional advertising. “Instead of possessing to pay as a result of the roof for each and every new client you generate, you are just acquiring new people today all the time by means of referrals that arrive in from your community,” mentioned Christina Farr, an investor at enterprise business, OMERS Ventures. Farr’s fund is experiencing this with a organization in its portfolio, Oath Treatment,…

-

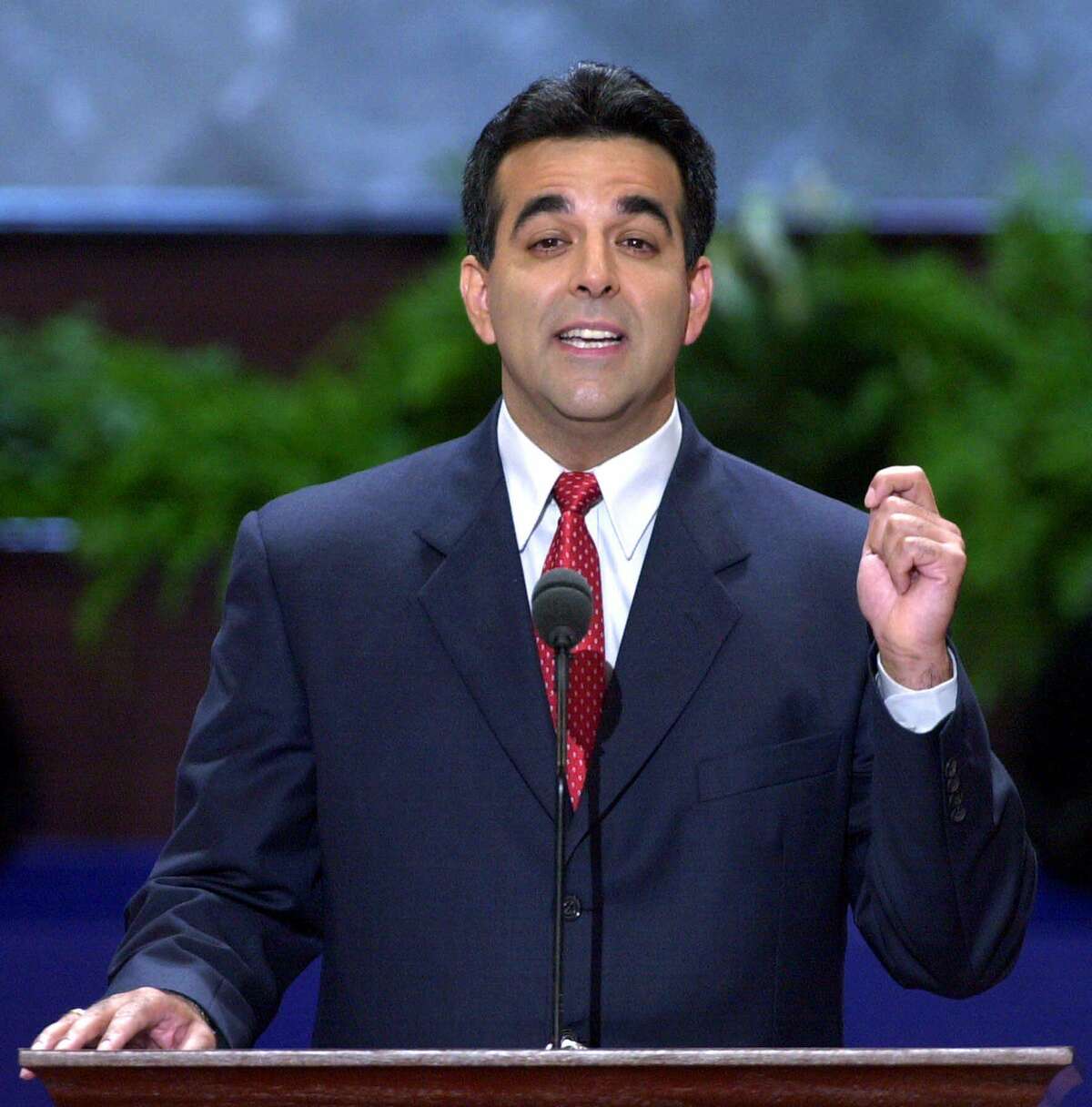

NH Business: Upcoming health care decisions

Fred Kocher, NH Business enterprise host NH Small business: Political decisions about wellbeing care Fred Kocher is joined by Courtney Tanner and David Juvet to talk about how forthcoming political selections will effect overall health treatment in the Granite State. Up-to-date: 7:45 AM EST Nov 27, 2022 Conceal Transcript Demonstrate Transcript WELCOME TO NEW HAMPSHIRE’S Company. I AM FRED COKER. POLITICAL Decisions ARE Being Built IN NEW HAMPSHIRE ABOUT OUR Health Care AND. THE Concern IS, ARE Individuals Choices Producing IT Improved OR Worse? AND SOME Organizations ARE NOW WEIGHING IN. HERE’S A Estimate FROM One OF MY Guests. No matter whether YOU Discover POLITICS Fascinating OR NOT, THEY Possible…

-

From Villain to Vanguard: Exploring Private Equity’s Role in Behavioral Health Care

In October, private equity firm Lee Equity Partners acquired compound use ailment company Bradford Well being. A pair months prior, Charlesbank Cash Associates – one more PE player – acquired autism provider Motion Conduct Facilities. And in July, Revelstoke Capital Associates bought eating problem big Monte Nido & Associates. These a few deals and some others like it replicate how personal equity is immediately increasing its get to in behavioral wellness care. In excess of the past ten years, PE investors have poured billions of pounds into behavioral well being. In modern several years, they’ve been attracted by skyrocketing need for providers subsequent the COVID-19 pandemic and the option to…