-

A New Student Loan Program Could Forgive Debt for Thousands

President Biden’s system to forgive up to $20,000 in college student mortgage debt for 40 million People is stalled—ensnared in conservative authorized challenges that could block financial debt reduction for months, or even for excellent. But the Division of Instruction has introduced a independent software that could decrease the student financial loan stress for up to 3.6 million borrowers—and forgive the financial loans of more than 40,000 Us citizens. This initiative was rolled out previously this year to rectify lenders’ exercise of steering debtors away from courses that could sooner or later forgive their university student bank loan credit card debt. It will influence significantly less debtors than Biden’s student…

-

Latest White House plan would forgive $10,000 in student debt per borrower

Placeholder while article actions load White House officials are currently planning to cancel $10,000 in student debt per borrower, after months of internal deliberations over how to structure loan forgiveness for tens of millions of Americans, three people with knowledge of the matter said. President Biden had hoped to make the announcement as soon as this weekend at the University of Delaware commencement, the people said, but that timing has changed after the massacre Tuesday in Texas. The White House’s latest plans called for limiting debt forgiveness to Americans who earned less than $150,000 in the previous year, or less than $300,000 for married couples filing jointly, two of the…

-

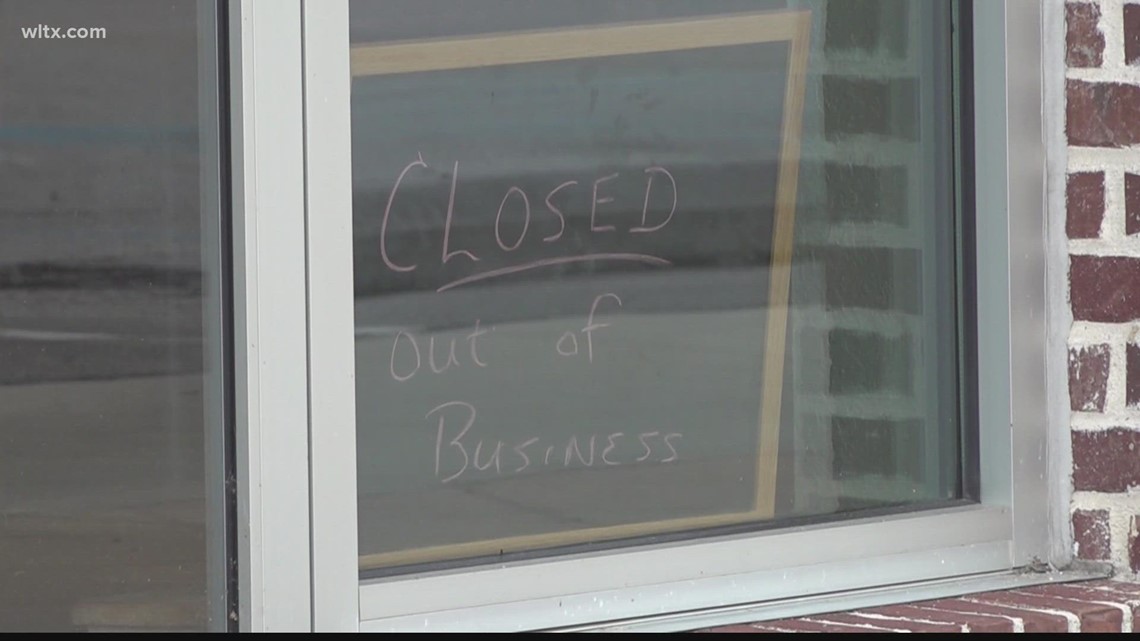

Bank of America Is Refusing to Fully Forgive Some PPP Loans

Bank of America, the second-biggest lender in the Paycheck Protection Program, is refusing to forgive some small business owners’ loans and blocking them from getting relief directly from the Small Business Administration, which oversees the PPP program. One of the first forms of aid Congress offered to businesses during the Covid-19 pandemic was PPP loans, which were meant to be forgiven completely if used to cover payroll and other specified expenses. But in over a half-dozen interviews and emails with The Intercept, small business owners who got their PPP loans through Bank of America described the same experience: A year or more after they first received their loans, they were…