-

Losses from home business – Monterey Herald

Issue: My spouse has a multi-stage dwelling business enterprise advertising “adult” solutions. For the past 5-furthermore many years, she has not shown a profit on her Agenda C submitted with our Forms 1040. Can we continue on to deduct losses on our tax return in perpetuity? Is there a limit as to the amount of decades that we can display losses? Response: Frequently, losses from your business enterprise will be deductible from your gross earnings. On the other hand, the Inner Earnings Provider may perhaps acquire the posture that your wife’s organization is a “hobby” and not a “for-profit business.” This posture would disallow all the losses you have formerly…

-

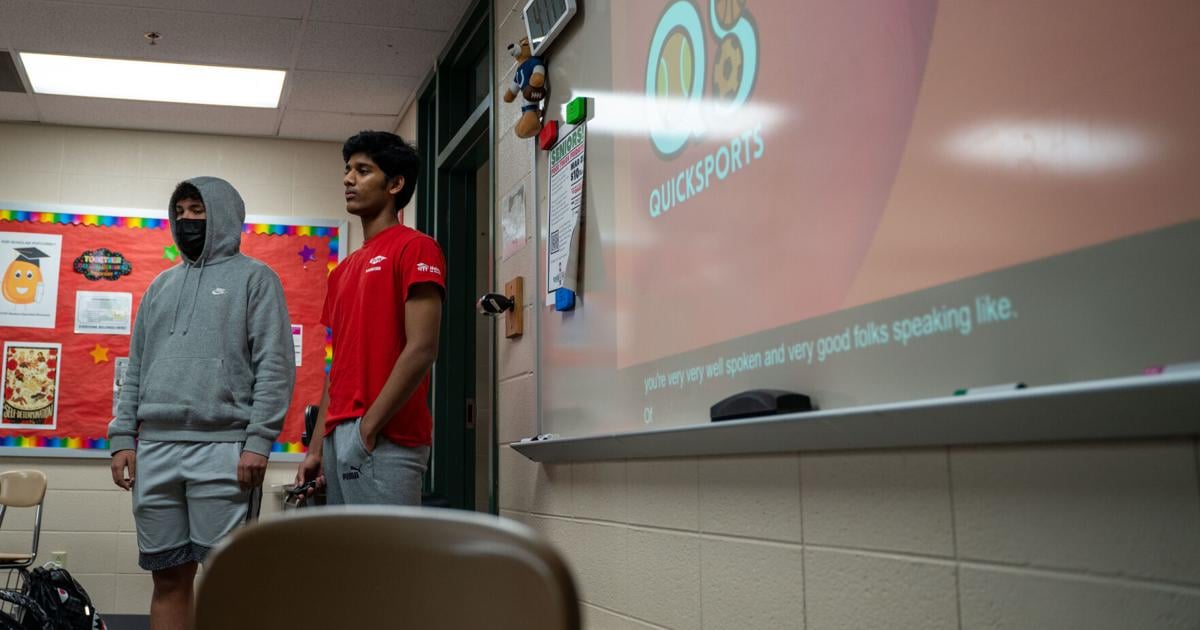

For the entrepreneurship-curious, Startup Weekend provides some training in how to turn that business idea into a fully-developed enterprise. | Monterey County NOW Intro

Tajha Chappellet-Lanier in this article, thinking about my buddies for whom business enterprise ideas movement like water. I, on the other hand, have never been adept at capitalizing on my passions or talents, which could generously be interpreted as an objection to the idea that all passions and skills should really grow to be financial enterprises. More realistically, however, I imagine it’s indicative of a pretty various way of contemplating. But let us say you’re an individual with a bunch of enterprise strategies. What comes next? Turning an notion into an actual organization calls for abilities you may not have yet—but kinds you can master. Techstars Startup Weekend, a Cal…