-

How To Calculate Your Debt-To-Income Ratio For A Mortgage

There’s a lot that goes into the home buying process, especially if you’re a first-time home buyer. One criteria mortgage lenders use to assess your mortgage application is the debt-to-income ratio (DTI). Your debt-to-income ratio is a comparison of how much you owe (your debt) to how much money you earn (your income). The income you make before taxes (your gross income) is used to measure this number. A lower debt-to-income ratio tells lenders you have a healthy balance between debt and income. However, a higher debt-to-income ratio indicates that too much of your income is dedicated to paying down debt. This could make some lenders see you as a risky…

-

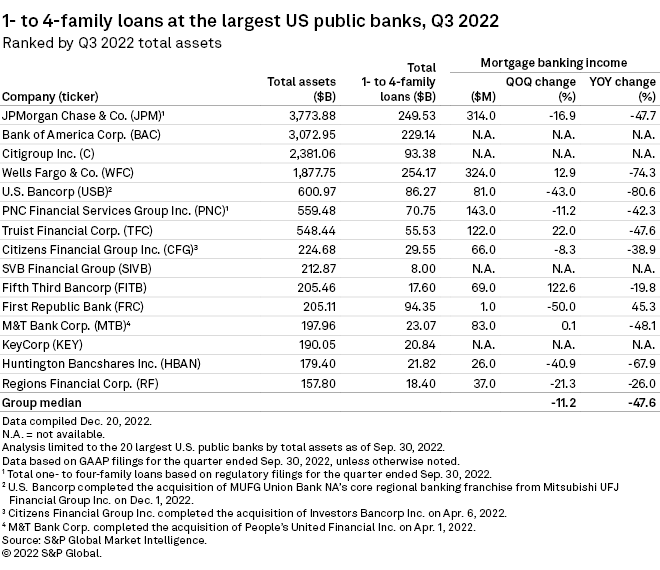

‘Brutal’ mortgage industry presents challenges, opportunities for banks in 2023

Banks’ mortgage-related fee income will remain challenged in 2023 as the lending segment continues to face headwinds, but the challenging environment also presents M&A and talent acquisition opportunities for banks to bulk up ahead of the next up-cycle, according to industry experts. Of the 15 largest public banks by total assets as of Sept. 30, seven reported quarter-over-quarter declines in mortgage banking income from one- to-four family loans in the third quarter and 10 saw a year-over-year decline, according to S&P Global Market Intelligence data. The group saw a median decline of 11.2{8ba6a1175a1c659bbdaa9a04b06717769bcea92c0fdf198d429188ebbca09471} quarter over quarter and 47.6{8ba6a1175a1c659bbdaa9a04b06717769bcea92c0fdf198d429188ebbca09471} year over year. Some of the largest drops in mortgage fee income…

-

KC-based James B. Nutter & Co. quits home mortgage business

James Nutter Jr., still left, and his father, the late James Nutter,. constructed 1 of the major privately held house loan firms in the United States. Wealthy SUGG The Kansas Town Star Kansas Metropolis-primarily based James B. Nutter & Co., one particular of the nation’s biggest private property finance loan creditors that because its founding in 1951 served hundreds of thousands of Us citizens obtain their initial houses, has announced that it is likely out of the household financial loan organization. The information will come as the organization enters the third year of a high-priced authorized struggle with the U.S. Department of Justice more than Nutter’s alleged mishandling of so-called…

-

Redfin will buy Bay Equity Home Loans for $135M in bid to boost mortgage business

(GeekWire Photograph / Nat Levy) Seattle serious estate big Redfin announced that it will pay an approximated $135 million in income and stock to order Bay Equity House Financial loans, a Bay Place-centered home loan loan company that is energetic in 42 states and employs 1,200 persons. The deal really should supply a improve to Redfin’s lending organization. Bay Fairness closed $8.5 billion in financial loans very last year and is virtually 10X the measurement of Redfin Home loan. It has also produced positive internet cash flow each of the past a few many years. Redfin will consolidate its Redfin Mortgage operations underneath Bay Fairness, which will keep its identify…