-

Kim Heng (Catalist:5G2) Is Doing The Right Things To Multiply Its Share Price

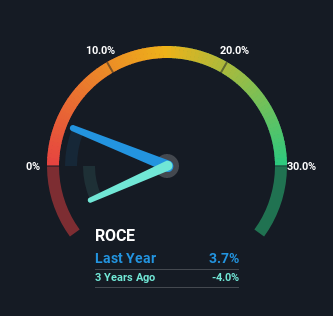

Did you know there are some money metrics that can supply clues of a opportunity multi-bagger? Among other factors, we will want to see two issues firstly, a rising return on money employed (ROCE) and next, an expansion in the company’s total of funds employed. If you see this, it ordinarily indicates it can be a organization with a excellent business enterprise model and loads of lucrative reinvestment chances. Talking of which, we noticed some excellent adjustments in Kim Heng’s (Catalist:5G2) returns on cash, so let’s have a glance. What Is Return On Funds Used (ROCE)? For those people that are not absolutely sure what ROCE is, it measures the…

-

Hume Cement Industries Berhad (KLSE:HUMEIND) Has More To Do To Multiply In Value Going Forward

If you happen to be not certain the place to get started when on the lookout for the subsequent multi-bagger, there are a couple crucial developments you should maintain an eye out for. Amongst other points, we will want to see two issues firstly, a escalating return on capital used (ROCE) and next, an expansion in the company’s volume of money used. In the end, this demonstrates that it can be a company that is reinvesting revenue at rising charges of return. Even so, immediately after briefly on the lookout above the quantities, we don’t assume Hume Cement Industries Berhad (KLSE:HUMEIND) has the makings of a multi-bagger heading ahead, but…