-

Under The Bonnet, Harte Hanks’ (NASDAQ:HHS) Returns Look Impressive

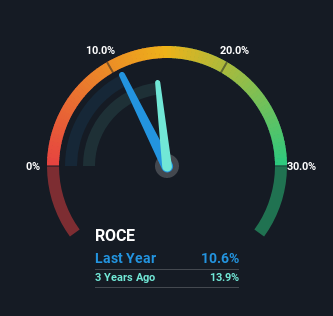

There are a handful of essential developments to glimpse for if we want to recognize the up coming multi-bagger. Preferably, a business enterprise will display two trends to begin with a escalating return on capital employed (ROCE) and next, an escalating sum of money utilized. This reveals us that it is a compounding equipment, capable to continually reinvest its earnings again into the enterprise and generate better returns. And in light-weight of that, the traits we’re viewing at Harte Hanks’ (NASDAQ:HHS) look quite promising so lets just take a glimpse. What Is Return On Funds Used (ROCE)? Just to make clear if you might be not sure, ROCE is a…

-

Why We Like The Returns At Gas Malaysia Berhad (KLSE:GASMSIA)

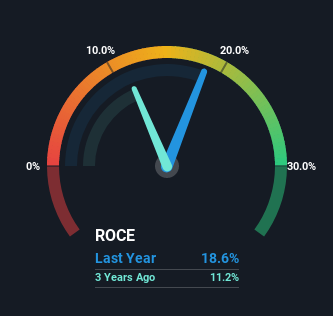

If you’re not confident the place to get started when wanting for the following multi-bagger, there are a couple of essential tendencies you need to continue to keep an eye out for. Generally, we’ll want to discover a pattern of escalating return on funds employed (ROCE) and alongside that, an growing base of funds used. This displays us that it is really a compounding equipment, capable to constantly reinvest its earnings back again into the business enterprise and create increased returns. With that in mind, the ROCE of Gasoline Malaysia Berhad (KLSE:GASMSIA) appears to be fantastic, so allows see what the trend can tell us. Understanding Return On Capital Used…

-

There’s Been No Shortage Of Growth Recently For Boustead Plantations Berhad’s (KLSE:BPLANT) Returns On Capital

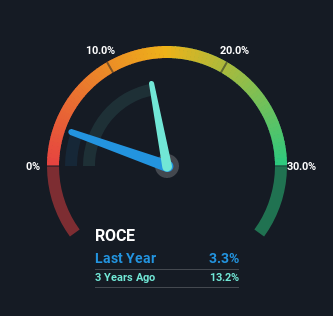

What traits need to we seem for it we want to discover stocks that can multiply in worth more than the long expression? Typically, we will want to recognize a development of growing return on money utilized (ROCE) and alongside that, an growing foundation of funds utilized. If you see this, it generally usually means it’s a enterprise with a wonderful small business product and a lot of profitable reinvestment opportunities. So when we seemed at Boustead Plantations Berhad (KLSE:BPLANT) and its craze of ROCE, we genuinely preferred what we observed. What Is Return On Funds Used (ROCE)? If you have not worked with ROCE ahead of, it steps the…

-

Synopsys (NASDAQ:SNPS) Is Looking To Continue Growing Its Returns On Capital

What developments should really we glance for it we want to detect shares that can multiply in price above the very long term? A person widespread method is to check out and uncover a business with returns on money used (ROCE) that are raising, in conjunction with a expanding total of money utilized. Ultimately, this demonstrates that it’s a company that is reinvesting profits at raising charges of return. With that in brain, we have found some promising developments at Synopsys (NASDAQ:SNPS) so let’s seem a bit deeper. Comprehending Return On Cash Utilized (ROCE) For these that aren’t confident what ROCE is, it actions the amount of money of pre-tax…

-

Tan Chong Motor Holdings Berhad’s (KLSE:TCHONG) Returns On Capital Are Heading Higher

Did you know there are some fiscal metrics that can offer clues of a prospective multi-bagger? Amongst other factors, we’ll want to see two issues for starters, a rising return on cash employed (ROCE) and secondly, an expansion in the company’s amount of money of capital employed. Put basically, these kinds of enterprises are compounding devices, meaning they are frequently reinvesting their earnings at at any time-bigger fees of return. Speaking of which, we observed some wonderful adjustments in Tan Chong Motor Holdings Berhad’s (KLSE:TCHONG) returns on money, so let’s have a glimpse. Return On Funds Used (ROCE): What Is It? If you have not labored with ROCE in advance…

-

Returns At Finning International (TSE:FTT) Are On The Way Up

If you might be not certain in which to begin when searching for the upcoming multi-bagger, there are a number of essential developments you must keep an eye out for. A person frequent method is to attempt and obtain a organization with returns on cash employed (ROCE) that are rising, in conjunction with a escalating total of capital used. Mainly this indicates that a firm has rewarding initiatives that it can continue on to reinvest in, which is a trait of a compounding machine. Speaking of which, we noticed some good changes in Finning International’s (TSE:FTT) returns on money, so let us have a look. Return On Money Employed (ROCE):…