-

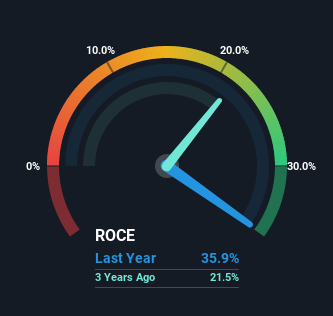

Shareholders Would Enjoy A Repeat Of PBT Group’s (JSE:PBG) Recent Growth In Returns

Did you know there are some financial metrics that can supply clues of a potential multi-bagger? Firstly, we are going to want to see a established return on capital used (ROCE) that is escalating, and secondly, an growing base of cash used. Generally this means that a company has profitable initiatives that it can carry on to reinvest in, which is a trait of a compounding device. With that in brain, the ROCE of PBT Group (JSE:PBG) appears to be like wonderful, so lets see what the craze can convey to us. What Is Return On Capital Employed (ROCE)? If you haven’t labored with ROCE right before, it steps the…

-

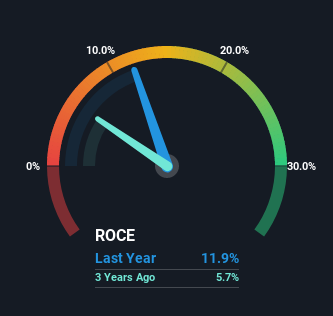

Waterco (ASX:WAT) Shareholders Will Want The ROCE Trajectory To Continue

If you’re seeking for a multi-bagger, you will find a several factors to hold an eye out for. Amongst other items, we will want to see two things for starters, a growing return on money utilized (ROCE) and next, an growth in the company’s volume of capital employed. In the end, this demonstrates that it can be a business enterprise that is reinvesting earnings at rising fees of return. Speaking of which, we found some wonderful modifications in Waterco’s (ASX:WAT) returns on money, so let us have a seem. Comprehension Return On Cash Used (ROCE) For people who don’t know, ROCE is a evaluate of a firm’s yearly pre-tax income…