-

Millennials face financial disappointment with student loan relief on pause

When he initial read about President Joe Biden’s approach to forgive college student bank loan personal debt for hundreds of thousands of federal borrowers, Travis Rapoza was cautiously optimistic. A Pell Grant recipient, Rapoza qualifies for $20,000 in personal loan forgiveness underneath the plan that Biden unveiled in August. Coupled with dollars he’s saved even though residing with his mothers and fathers for the earlier 4 several years, he would eventually be debt-absolutely free and could go out on his have. Ultimately, Rapoza thought, his era was staying read by leaders in Washington D.C. Eventually, a little something was getting done to address the fiscal panic and hardship numerous millennials…

-

Grad Wipes Out Student Loan Debt, Affords Surgery After Flipping TVs on Facebook

Melanie Brecht claimed she was equipped to fork out off her scholar debt by flipping TVs on Facebook Market. When she was an intercontinental pupil in Canada, Brecht reported she experienced compensated far more in tuition. Immediately after paying out off her financial debt, Brecht saved more than enough funds to acquire the beauty nose surgical procedures she constantly needed. Loading Something is loading. Many thanks for signing up! Accessibility your favourite topics in a personalised feed while you happen to be on the go. down load the application Melanie Brecht generally wished beauty nose operation, but just after taking on a important quantity of college student mortgage personal debt,…

-

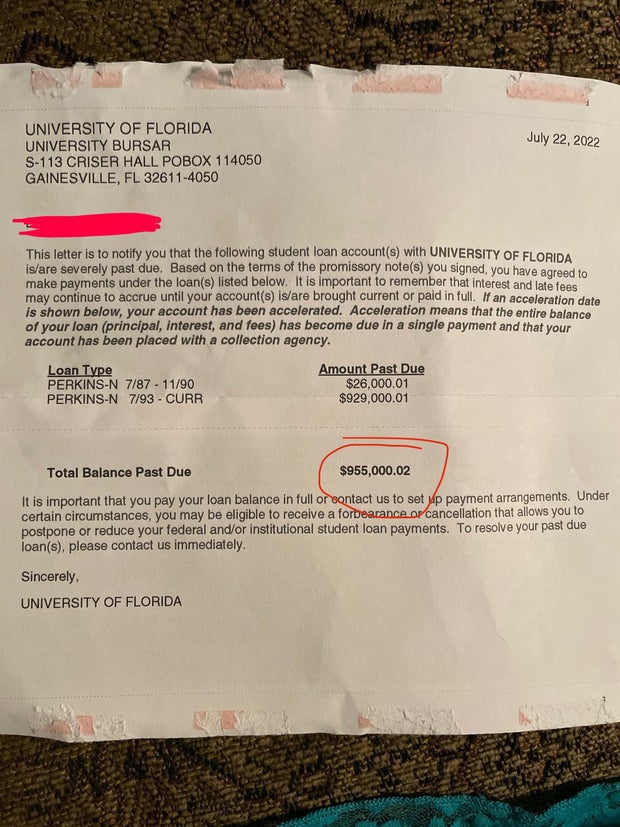

A Florida teacher thought she’d settled her student loan debt 20 years ago. Then she got a bill for $1 million.

For pretty much a ten years, the authorities took hundreds of bucks every thirty day period out of the paychecks of a Florida woman named Michelle to recoup previous student loans that were being unpaid and overdue. The method, known as garnishment, is legal, and the U.S. Section of Training can purchase it for someone’s wages, tax returns and Social Protection to power repayment on defaulted loans. Michelle’s garnishment began in 2008. As a general public university teacher in Orlando, who questioned to be discovered by her initially name only simply because this tale consists of her own finances, she struggled for the upcoming eight or nine many years to…

-

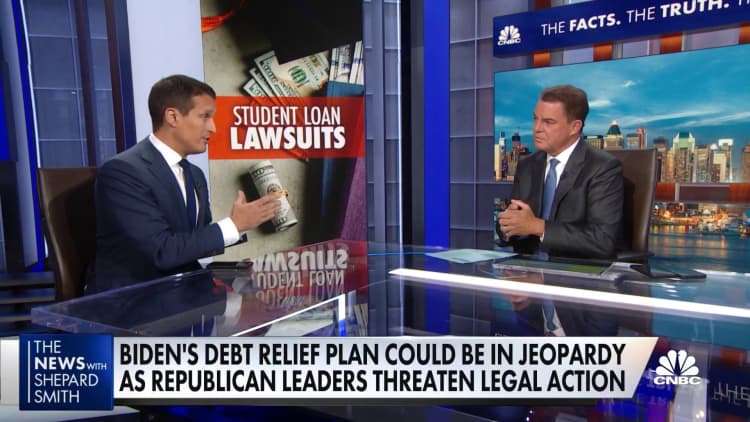

How the Supreme Court Could Rule on Student Loan Forgiveness

The U.S. Supreme Court docket is making ready to weigh in on the authorized struggle around President Biden’s university student financial loan forgiveness plan, which is now blocked by two various rulings. But, legal industry experts say that even if the court sides with the Biden Administration, there are continue to legal hurdles that will hold off relief for debtors. In a submitting on Friday, Solicitor Common Elizabeth Prelogar requested the Supreme Court docket to vacate a nationwide injunction on the personal debt-forgiveness plan or “set the circumstance for expedited briefing and argument this Time period to avoid prolonging this uncertainty for the millions of impacted debtors.” In the meantime,…

-

Student loan forgiveness approval letters are going out. Here’s what that means.

About 16 million debtors who had utilized for the Biden administration’s pupil mortgage forgiveness program been given letters above the weekend letting them know that they have been approved for credit card debt reduction. Nevertheless, the letter states that a range of lawsuits “have blocked our capacity to discharge your credit card debt at existing.” The approvals come following two courts blocked the strategy, putting legal boundaries right before a federal program that had promised to forgive up to $20,000 in university student credit card debt for about 40 million suitable Us citizens. “Your software is total and accredited, and we will discharge your accepted financial debt if and when we prevail…

-

Student loan relief: Biden administration notifies approved applicants as program remains tied up in courts

CNN — The Biden administration started off notifying individuals who are approved for federal university student personal loan reduction on Saturday even as the upcoming of that reduction continues to be in limbo just after lower courts blocked the application nationwide. The Department of Education and learning began sending email messages to debtors who have been accepted to have their federal pupil financial loans relieved, outlining that latest legal difficulties have saved the administration from discharging the debt. “We reviewed your application and established that you are qualified for loan aid underneath the Approach,” Training Secretary Miguel Cardona wrote in the e-mail, which was furnished to CNN. “We have sent…