Business Analysts

-

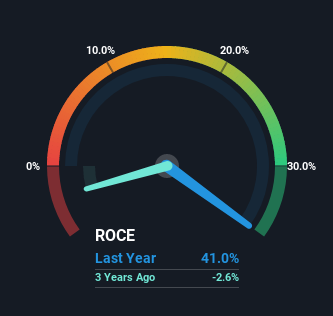

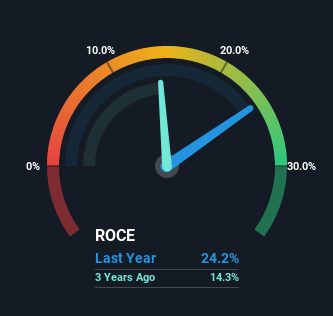

Total Energy Services’ (TSE:TOT) Returns On Capital Are Heading Higher

To uncover a multi-bagger inventory, what are the underlying traits we should glance for in a business enterprise? Ideally, a business will show two developments firstly a increasing return on cash used (ROCE) and secondly, an increasing amount of funds employed. In the end, this demonstrates that it is really a small business that is reinvesting revenue at increasing rates of return. So when we looked at Whole Vitality Solutions (TSE:TOT) and its trend of ROCE, we genuinely appreciated what we observed. Return On Money Employed (ROCE): What Is It? For these who never know, ROCE is a evaluate of a firm’s yearly pre-tax profit (its return), relative to the…

-

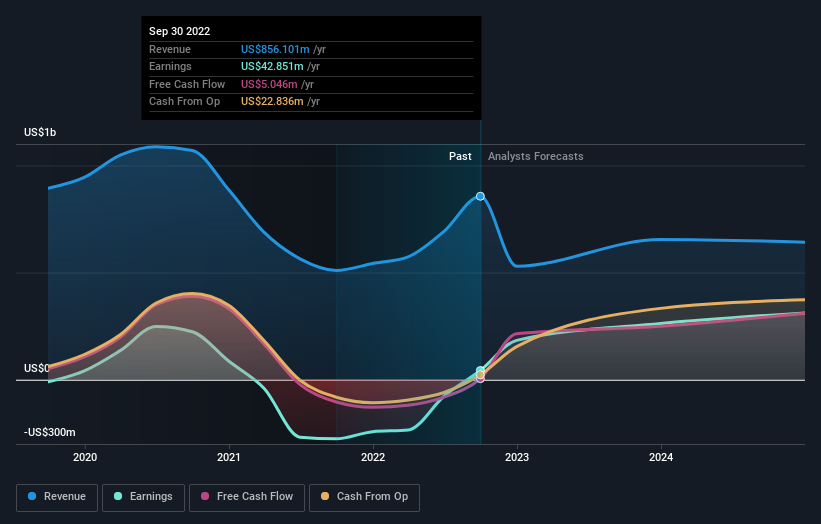

Nvidia’s results suggest its gaming business is close to a bottom, analysts say

The hottest results from Nvidia suggest a gaming base is in sight for the battered semiconductor stock, according to analysts. The chipmaker on Wednesday posted a mixed quarter, with earnings slipping somewhat underneath analysts’ expectations . Revenue fell 17{8ba6a1175a1c659bbdaa9a04b06717769bcea92c0fdf198d429188ebbca09471} calendar year above yr. Nvidia’s gaming division claimed a 51{8ba6a1175a1c659bbdaa9a04b06717769bcea92c0fdf198d429188ebbca09471} drop in income as the Computer gaming market place slows from pandemic-period growth and retailers grapple with a glut of stock. Irrespective of the troublesome gaming print, Wells Fargo’s Aaron Rakers stated the bank is becoming more and more self-assured that the division is nearing its bottom, anticipating stock to near “normalized amounts” going out of the fourth quarter. “New product…

-

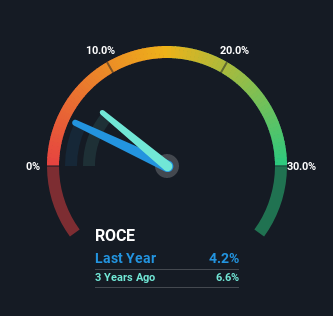

The Returns At Uzma Berhad (KLSE:UZMA) Aren’t Growing

If you’re not absolutely sure wherever to start off when wanting for the future multi-bagger, there are a couple important traits you should really maintain an eye out for. Firstly, we will want to see a tested return on capital utilized (ROCE) that is rising, and secondly, an growing foundation of capital used. If you see this, it usually implies it is a corporation with a terrific small business design and a lot of lucrative reinvestment prospects. Getting said that, from a very first glance at Uzma Berhad (KLSE:UZMA) we aren’t jumping out of our chairs at how returns are trending, but let’s have a deeper appear. Being familiar with…

-

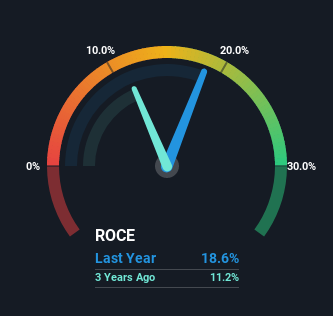

YouGov (LON:YOU) Knows How To Allocate Capital Effectively

Locating a company that has the possible to increase considerably is not effortless, but it is possible if we look at a couple essential economic metrics. Generally, we are going to want to detect a craze of developing return on cash utilized (ROCE) and along with that, an expanding foundation of capital used. If you see this, it commonly usually means it’s a firm with a fantastic enterprise model and plenty of profitable reinvestment opportunities. And in mild of that, the trends we are viewing at YouGov’s (LON:YOU) seem very promising so allows just take a glance. Return On Funds Utilized (ROCE): What Is It? For those that aren’t absolutely…

-

Beyond the Decade of Data: Business Must Consider Their Legacy

Once in a generation, the alternatives to generate a business legacy boost massively when tectonic shifts quake the small business and engineering ecosystem. And with knowledge volumes exploding at a rate of about 2.5 quintillion bytes per day, and where by in some conditions, a company’s info is two or three moments far more worthwhile than the enterprise itself, we are very evidently living in the ‘defining ten years of data’. For a small business to direct in this place it have to set up the situations for very long-phrase advancement and achievement. That indicates constructing a tech and analytics stack that will choose ideal of breed methods and future-evidence…

-

Here are Wall Street analysts’ favorite retail stocks as giants such as Target get set to report

Some of the greatest stores in the U.S. are set to report their newest quarterly figures this week, potentially providing insight on how very well customers are faring with inflation and the broader macroeconomic surroundings. Walmart and House Depot are slated to report Tuesday. Target’s results are scheduled for Wednesday, together with TJX. The sector has broadly struggled this year, with the SPDR S & P Retail ETF (XRT) falling 27.4{8ba6a1175a1c659bbdaa9a04b06717769bcea92c0fdf198d429188ebbca09471}, as individuals control discretionary spending due to sturdy inflationary pressures. This has led to extra inventories for merchants as effectively as to increased promotions to distinct individuals products. Irrespective of this backdrop, analysts see upside in some retailers. To…