Business Analysts

-

Forecast: Analysts Think Teekay Tankers Ltd.’s (NYSE:TNK) Business Prospects Have Improved Drastically

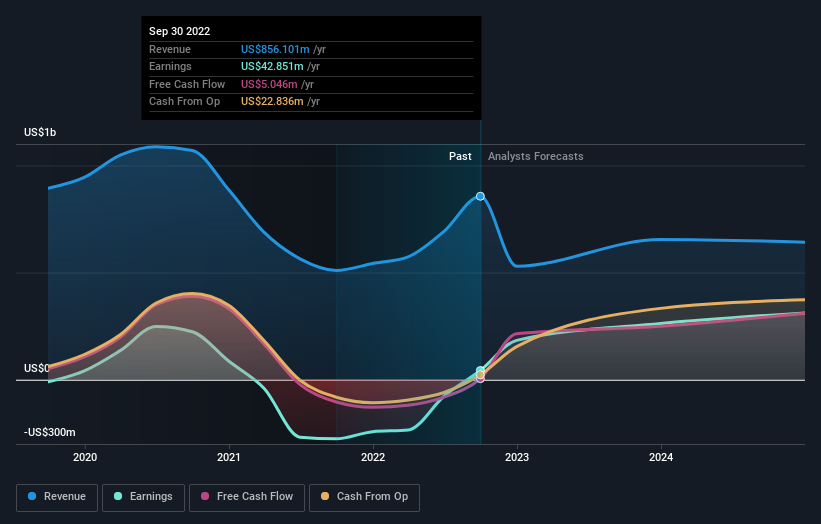

Shareholders in Teekay Tankers Ltd. (NYSE:TNK) may be thrilled to master that the analysts have just delivered a major enhance to their in the vicinity of-expression forecasts. Consensus estimates recommend traders could expect greatly enhanced statutory revenues and earnings for each share, with the analysts modelling a serious advancement in organization performance. Right after the update, the consensus from Teekay Tankers’ six analysts is for revenues of US$655m in 2023, which would replicate a concerning 24{8ba6a1175a1c659bbdaa9a04b06717769bcea92c0fdf198d429188ebbca09471} decrease in gross sales compared to the previous 12 months of general performance. For each-share earnings are expected to bounce 509{8ba6a1175a1c659bbdaa9a04b06717769bcea92c0fdf198d429188ebbca09471} to US$7.69. Prior to this update, the analysts experienced been forecasting revenues of…

-

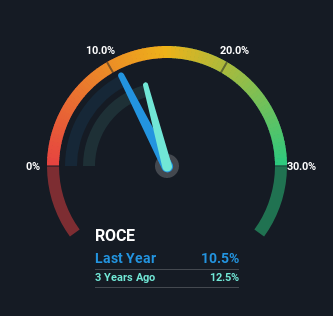

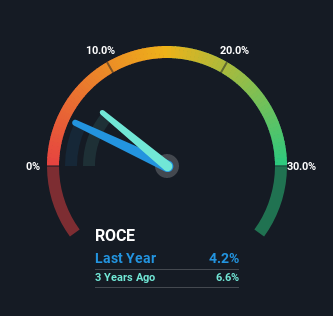

Investors Met With Slowing Returns on Capital At Ecolab (NYSE:ECL)

If you might be wanting for a multi-bagger, you can find a handful of items to keep an eye out for. To begin with, we’ll want to see a demonstrated return on capital utilized (ROCE) that is expanding, and next, an increasing foundation of money used. Essentially this signifies that a firm has profitable initiatives that it can keep on to reinvest in, which is a trait of a compounding machine. Despite the fact that, when we seemed at Ecolab (NYSE:ECL), it didn’t seem to tick all of these containers. Return On Funds Used (ROCE): What Is It? Just to clarify if you might be unsure, ROCE is a metric…

-

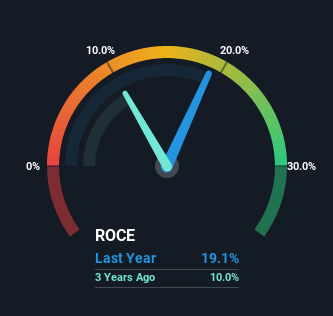

Premier Investments (ASX:PMV) Is Experiencing Growth In Returns On Capital

There are a handful of critical traits to glimpse for if we want to establish the future multi-bagger. In a excellent planet, we might like to see a firm investing additional money into its business enterprise and preferably the returns acquired from that money are also growing. If you see this, it generally signifies it is a company with a terrific small business product and a good deal of financially rewarding reinvestment possibilities. Speaking of which, we recognized some good alterations in Leading Investments’ (ASX:PMV) returns on funds, so let’s have a appear. What Is Return On Funds Utilized (ROCE)? For those people that are not absolutely sure what ROCE…

-

Analysis: China’s great reopening may come too late for many businesses

SHANGHAI, Nov 22 (Reuters) – The culinary tourism organization of Brian Bergey and his spouse Ruixi Hu has persevered in China by means of 3 many years of harsh COVID-19 limitations. But just as enjoyment is mounting in world wide money marketplaces that the world’s next-most significant economy may perhaps finally come out of isolation upcoming 12 months, the two are packing their bags. “I continue being pretty pessimistic about the estimate-unquote reopening of China,” claimed Bergey. Their Lost Plate company, which has been web hosting foods excursions in several Chinese towns considering the fact that 2015, will as an alternative veer to Southeast Asia. China, the very last between…

-

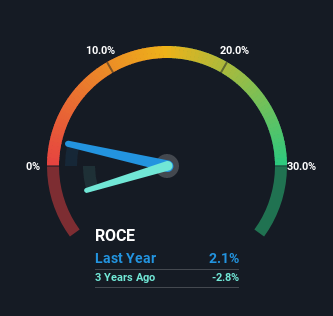

Bidvest Group’s (JSE:BVT) Returns On Capital Not Reflecting Well On The Business

Did you know there are some fiscal metrics that can present clues of a potential multi-bagger? To begin with, we’ll want to see a proven return on funds employed (ROCE) that is increasing, and next, an expanding base of capital used. Essentially this signifies that a corporation has successful initiatives that it can carry on to reinvest in, which is a trait of a compounding equipment. Getting said that, from a initial look at Bidvest Group (JSE:BVT) we are not leaping out of our chairs at how returns are trending, but let’s have a further glance. What Is Return On Cash Utilized (ROCE)? For those people who don’t know, ROCE…

-

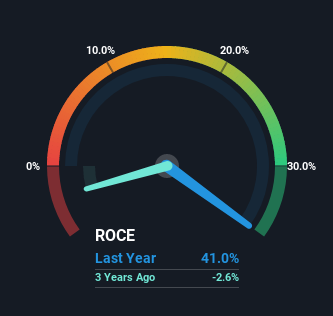

Returns Are Gaining Momentum At Far East Group (Catalist:5TJ)

What are the early developments we must appear for to determine a stock that could multiply in benefit around the extensive time period? In a excellent entire world, we’d like to see a firm investing a lot more capital into its organization and preferably the returns acquired from that cash are also growing. If you see this, it usually implies it can be a organization with a excellent business design and a good deal of financially rewarding reinvestment options. With that in head, we have found some promising trends at Much East Team (Catalist:5TJ) so let’s seem a little bit deeper. Return On Funds Used (ROCE): What Is It? If…