-

Starting a Business with Zero Capital: 15 Steps & Ideas for Success

Starting off a modest enterprise with no dollars to make investments is 100{8ba6a1175a1c659bbdaa9a04b06717769bcea92c0fdf198d429188ebbca09471} possible. In actuality, you can do it a lot more simply than companies like Google, Facebook, Apple, Mattel, and Harley Davidson when they began functions a long time ago. Why? Just since it has in no way been so easy to go from a very simple concept to a startup, establish something of value and attain prospective buyers as it’s now. You just want an entrepreneurial mentality: tough function, commitment, creativeness, and willingness to exam new waters. How To Start off A Company With No Dollars If you really do not want to spend any cash, listed here…

-

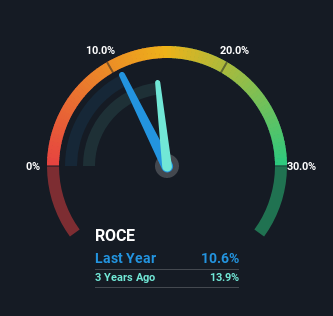

Bahvest Resources Berhad (KLSE:BAHVEST) Is Experiencing Growth In Returns On Capital

What trends should really we glimpse for it we want to discover stocks that can multiply in benefit more than the very long time period? In a fantastic environment, we’d like to see a company investing extra funds into its organization and ideally the returns earned from that cash are also escalating. Finally, this demonstrates that it really is a enterprise that is reinvesting gains at increasing costs of return. So on that observe, Bahvest Assets Berhad (KLSE:BAHVEST) looks fairly promising in regards to its tendencies of return on funds. Return On Money Used (ROCE): What Is It? Just to make clear if you’re uncertain, ROCE is a metric for…

-

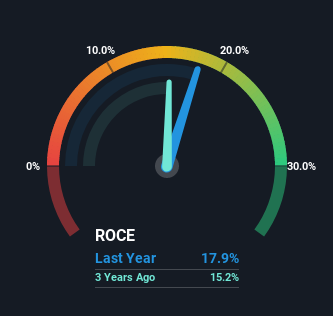

We Like These Underlying Return On Capital Trends At Kumpulan Perangsang Selangor Berhad (KLSE:KPS)

Acquiring a enterprise that has the likely to mature substantially is not simple, but it is probable if we seem at a number of key economical metrics. In a best planet, we’d like to see a firm investing a lot more cash into its business enterprise and ideally the returns gained from that money are also increasing. This shows us that it is really a compounding device, ready to continuously reinvest its earnings back again into the company and create better returns. Talking of which, we discovered some terrific modifications in Kumpulan Perangsang Selangor Berhad’s (KLSE:KPS) returns on cash, so let us have a appear. What Is Return On Capital…

-

Annaly Capital Management, Inc. Announces Steven F. Campbell Appointed as President

NEW YORK–(Business enterprise WIRE)–Annaly Cash Management, Inc. (NYSE: NLY) (“Annaly” or the “Company”) nowadays declared that the Board of Directors has appointed Steven F. Campbell, the Company’s Chief Running Officer, to the more place of work of President, successful instantly. As President and Chief Working Officer, Mr. Campbell will keep on to report to David Finkelstein, the Company’s Main Govt Officer and Chief Expense Officer, who previously held the role of President due to the fact March 2020. Mr. Campbell will proceed to work carefully with the govt group to help oversee Annaly’s all round tactic, operations and hazard administration. Mr. Campbell joined the Enterprise in April 2015 and has…

-

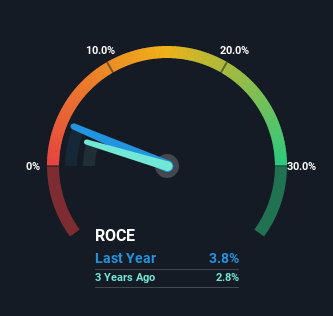

Be Wary Of Wabash National (NYSE:WNC) And Its Returns On Capital

To avoid investing in a business that’s in decline, there’s a few financial metrics that can provide early indications of aging. When we see a declining return on capital employed (ROCE) in conjunction with a declining base of capital employed, that’s often how a mature business shows signs of aging. This combination can tell you that not only is the company investing less, it’s earning less on what it does invest. And from a first read, things don’t look too good at Wabash National (NYSE:WNC), so let’s see why. What Is Return On Capital Employed (ROCE)? Just to clarify if you’re unsure, ROCE is a metric for evaluating how much…

-

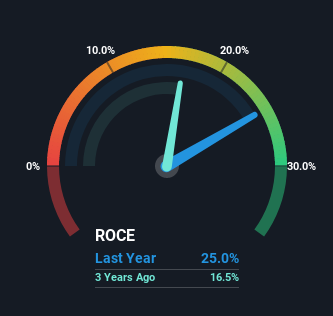

Why You Should Care About LCI Industries’ (NYSE:LCII) Strong Returns On Capital

Discovering a small business that has the likely to improve significantly is not effortless, but it is possible if we glimpse at a couple vital financial metrics. To begin with, we’d want to establish a expanding return on funds used (ROCE) and then alongside that, an ever-escalating base of capital used. In the end, this demonstrates that it’s a enterprise that is reinvesting revenue at increasing charges of return. Which is why when we briefly seemed at LCI Industries’ (NYSE:LCII) ROCE trend, we were quite happy with what we observed. Return On Capital Utilized (ROCE): What Is It? For people who will not know, ROCE is a measure of a…