-

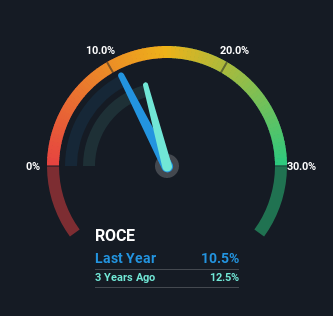

Investors Met With Slowing Returns on Capital At Ecolab (NYSE:ECL)

If you might be wanting for a multi-bagger, you can find a handful of items to keep an eye out for. To begin with, we’ll want to see a demonstrated return on capital utilized (ROCE) that is expanding, and next, an increasing foundation of money used. Essentially this signifies that a firm has profitable initiatives that it can keep on to reinvest in, which is a trait of a compounding machine. Despite the fact that, when we seemed at Ecolab (NYSE:ECL), it didn’t seem to tick all of these containers. Return On Funds Used (ROCE): What Is It? Just to clarify if you might be unsure, ROCE is a metric…

-

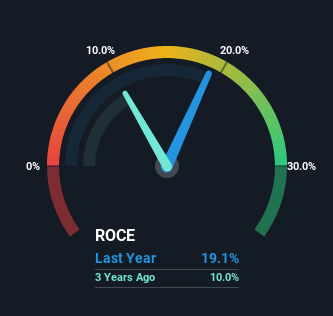

Premier Investments (ASX:PMV) Is Experiencing Growth In Returns On Capital

There are a handful of critical traits to glimpse for if we want to establish the future multi-bagger. In a excellent planet, we might like to see a firm investing additional money into its business enterprise and preferably the returns acquired from that money are also growing. If you see this, it generally signifies it is a company with a terrific small business product and a good deal of financially rewarding reinvestment possibilities. Speaking of which, we recognized some good alterations in Leading Investments’ (ASX:PMV) returns on funds, so let’s have a appear. What Is Return On Funds Utilized (ROCE)? For those people that are not absolutely sure what ROCE…

-

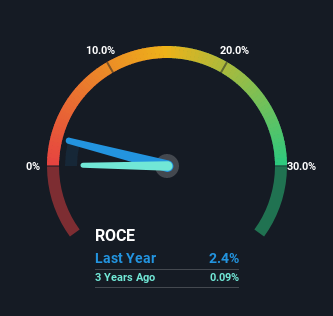

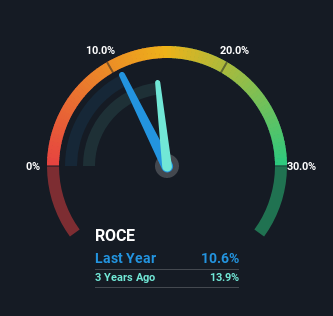

Bidvest Group’s (JSE:BVT) Returns On Capital Not Reflecting Well On The Business

Did you know there are some fiscal metrics that can present clues of a potential multi-bagger? To begin with, we’ll want to see a proven return on funds employed (ROCE) that is increasing, and next, an expanding base of capital used. Essentially this signifies that a corporation has successful initiatives that it can carry on to reinvest in, which is a trait of a compounding equipment. Getting said that, from a initial look at Bidvest Group (JSE:BVT) we are not leaping out of our chairs at how returns are trending, but let’s have a further glance. What Is Return On Cash Utilized (ROCE)? For those people who don’t know, ROCE…

-

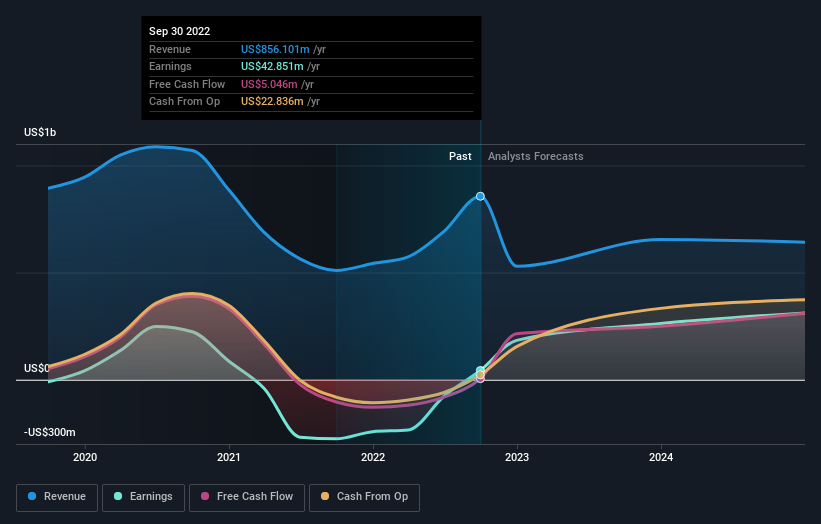

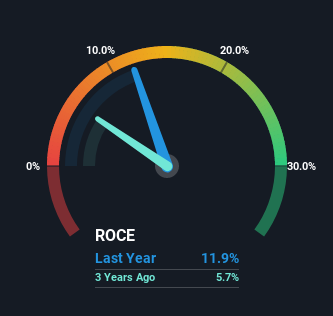

Total Energy Services’ (TSE:TOT) Returns On Capital Are Heading Higher

To uncover a multi-bagger inventory, what are the underlying traits we should glance for in a business enterprise? Ideally, a business will show two developments firstly a increasing return on cash used (ROCE) and secondly, an increasing amount of funds employed. In the end, this demonstrates that it is really a small business that is reinvesting revenue at increasing rates of return. So when we looked at Whole Vitality Solutions (TSE:TOT) and its trend of ROCE, we genuinely appreciated what we observed. Return On Money Employed (ROCE): What Is It? For these who never know, ROCE is a evaluate of a firm’s yearly pre-tax profit (its return), relative to the…

-

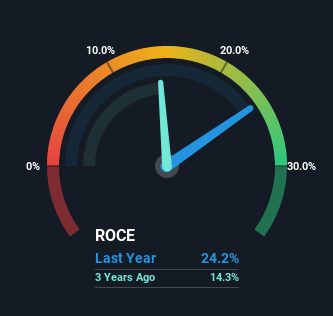

YouGov (LON:YOU) Knows How To Allocate Capital Effectively

Locating a company that has the possible to increase considerably is not effortless, but it is possible if we look at a couple essential economic metrics. Generally, we are going to want to detect a craze of developing return on cash utilized (ROCE) and along with that, an expanding foundation of capital used. If you see this, it commonly usually means it’s a firm with a fantastic enterprise model and plenty of profitable reinvestment opportunities. And in mild of that, the trends we are viewing at YouGov’s (LON:YOU) seem very promising so allows just take a glance. Return On Funds Utilized (ROCE): What Is It? For those that aren’t absolutely…

-

Embraer’s (BVMF:EMBR3) Returns On Capital Not Reflecting Well On The Business

If we want to find a opportunity multi-bagger, generally there are fundamental developments that can give clues. One popular tactic is to try and obtain a enterprise with returns on cash used (ROCE) that are rising, in conjunction with a developing quantity of capital used. In the long run, this demonstrates that it really is a small business that is reinvesting earnings at rising costs of return. Having said that, immediately after investigating Embraer (BVMF:EMBR3), we will not think it can be present-day trends in shape the mould of a multi-bagger. Return On Funds Utilized (ROCE): What Is It? For all those that usually are not guaranteed what ROCE is,…