Why We Like The Returns At Gas Malaysia Berhad (KLSE:GASMSIA)

If you’re not confident the place to get started when wanting for the following multi-bagger, there are a couple of essential tendencies you need to continue to keep an eye out for. Generally, we’ll want to discover a pattern of escalating return on funds employed (ROCE) and alongside that, an growing base of funds used. This displays us that it is really a compounding equipment, capable to constantly reinvest its earnings back again into the business enterprise and create increased returns. With that in mind, the ROCE of Gasoline Malaysia Berhad (KLSE:GASMSIA) appears to be fantastic, so allows see what the trend can tell us.

Understanding Return On Capital Used (ROCE)

Just to make clear if you are not sure, ROCE is a metric for analyzing how a lot pre-tax revenue (in percentage conditions) a corporation earns on the money invested in its business. Analysts use this components to estimate it for Gas Malaysia Berhad:

Return on Money Utilized = Earnings Just before Desire and Tax (EBIT) ÷ (Full Property – Latest Liabilities)

.35 = RM494m ÷ (RM3.0b – RM1.6b) (Based mostly on the trailing twelve months to September 2022).

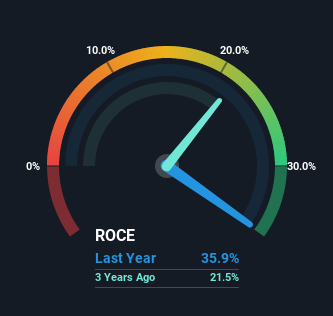

So, Gasoline Malaysia Berhad has an ROCE of 35{8ba6a1175a1c659bbdaa9a04b06717769bcea92c0fdf198d429188ebbca09471}. Which is a excellent return and not only that, it outpaces the regular of 8.{8ba6a1175a1c659bbdaa9a04b06717769bcea92c0fdf198d429188ebbca09471} earned by companies in a very similar industry.

Perspective our hottest examination for Gas Malaysia Berhad

Previously mentioned you can see how the recent ROCE for Fuel Malaysia Berhad compares to its prior returns on funds, but there is certainly only so a lot you can convey to from the past. If you would like, you can look at out the forecasts from the analysts masking Gasoline Malaysia Berhad in this article for absolutely free.

The Development Of ROCE

Gas Malaysia Berhad has not upset with their ROCE growth. The figures exhibit that around the previous five yrs, ROCE has developed 123{8ba6a1175a1c659bbdaa9a04b06717769bcea92c0fdf198d429188ebbca09471} whilst employing about the exact same volume of funds. So our get on this is that the small business has elevated efficiencies to generate these larger returns, all the whilst not needing to make any more investments. The company is carrying out nicely in that feeling, and it really is worth investigating what the management team has prepared for extended expression expansion prospective customers.

On a separate but similar observe, it can be vital to know that Gas Malaysia Berhad has a current liabilities to complete assets ratio of 52{8ba6a1175a1c659bbdaa9a04b06717769bcea92c0fdf198d429188ebbca09471}, which we would think about really superior. This efficiently signifies that suppliers (or quick-expression collectors) are funding a large portion of the business enterprise, so just be conscious that this can introduce some elements of risk. Though it can be not automatically a undesirable factor, it can be useful if this ratio is decrease.

The Base Line On Fuel Malaysia Berhad’s ROCE

To provide it all together, Gas Malaysia Berhad has finished properly to raise the returns it is creating from its cash utilized. Due to the fact the inventory has returned a stable 48{8ba6a1175a1c659bbdaa9a04b06717769bcea92c0fdf198d429188ebbca09471} to shareholders over the last five yrs, it really is reasonable to say traders are starting to acknowledge these alterations. For that reason, we imagine it would be worthy of your time to check if these tendencies are going to go on.

If you want to know some of the hazards struggling with Fuel Malaysia Berhad we have found 2 warning indicators (1 can’t be ignored!) that you really should be informed of ahead of investing listed here.

Fuel Malaysia Berhad is not the only stock earning high returns. If you would like to see a lot more, check out out our absolutely free listing of firms earning large returns on fairness with sound fundamentals.

Have feedback on this posting? Involved about the material? Get in contact with us instantly. Alternatively, email editorial-crew (at) simplywallst.com.

This posting by Only Wall St is common in mother nature. We deliver commentary based on historic information and analyst forecasts only employing an impartial methodology and our posts are not meant to be economic assistance. It does not represent a advice to get or offer any inventory, and does not get account of your goals, or your economical problem. We aim to carry you prolonged-phrase focused assessment driven by basic info. Note that our assessment may possibly not issue in the latest cost-sensitive enterprise bulletins or qualitative material. Simply Wall St has no posture in any shares mentioned.

Be a part of A Compensated Person Investigate Session

You will acquire a US$30 Amazon Gift card for 1 hour of your time while aiding us create improved investing equipment for the unique traders like your self. Indicator up below